Terms and Conditions of Your Account - Personal Banking

Online copies of our terms and conditions are provided only as a courtesy and convenience to you. If a discrepancy exists between these online copies and what has been provided to you by Simmons Bank, any documents provided to you by Simmons Bank shall govern.

Agreement

This document, along with any other documents we give you pertaining to your account(s), is a contract that establishes rules which control your account(s) with us and related matters. Please read this carefully and retain it for future reference. If you sign the signature card, otherwise indicate your acceptance of these terms, or open or continue to use the account, you agree to these rules. You will receive a separate schedule of rates, qualifying balances, and fees if they are not included in this document. If you have any questions, please call us.

This agreement requires that disputes be resolved through individual arbitration rather than jury trials or class action proceedings and limits your remedies in the event of a dispute. If you do not wish to agree to arbitration, please refer to the section entitled “Dispute Resolution by Binding Arbitration” for instructions on how to reject arbitration.

This agreement is subject to applicable federal laws, the laws of the state of Arkansas and other applicable rules such as the operating letters of the Federal Reserve Banks and payment processing system rules (except to the extent that this agreement can and does vary such rules or laws). The body of state and federal law that governs our relationship with you, however, is too large and complex to be reproduced here. The purpose of this document is to:

- establish rules to cover transactions or events which the law does not regulate;

- establish rules for certain transactions or events which the law regulates but permits variation by agreement; and

- give you disclosures of some of our policies to which you may be entitled or in which you may be interested.

If any provision of this document is found to be unenforceable according to its terms, all remaining provisions will continue in full force and effect. We may permit some variations from our standard agreement, but we must agree to any variation in writing either on the signature card for your account or in some other document. Nothing in this document is intended to vary our duty to act in good faith and with ordinary care when required by law. Our forbearance from, or delay in, exercising any of our rights, remedies, or privileges under this agreement or applicable law shall not be construed to be a waiver of those rights, remedies, or privileges.

As used in this document the words “we,” “our,” and “us” mean the financial institution (Simmons Bank), and the words “you” and “your” mean the account holder(s) and anyone else with the authority to deposit, withdraw, or exercise control over the funds in the account. However, this agreement does not intend, and the terms “you” and “your” should not be interpreted, to expand an individual’s responsibility for an organization’s liability. If this account is owned by a corporation, partnership or other organization, individual liability is determined by the laws generally applicable to that type of organization. The headings in this document are for convenience or reference only and will not govern the interpretation of the provisions. Unless it would be inconsistent to do so, words and phrases used in this document should be construed so the singular includes the plural and the plural includes the singular. Whenever the words, “include,” “includes,” or “including” are used in this agreement, they shall be deemed followed by the phrase “without limitation” (except to the extent such phrase, or a phrase of substantially similar meaning, is already expressly stated). Whenever the use of our discretion is referenced in this agreement, such discretion shall be deemed to mean our sole and absolute discretion.

Liability

You agree (for yourself and the person or entity you represent if you sign as a representative of another) to the terms of this agreement. You agree to pay all fees and charges applicable to the accounts and services we provide to you, including, but not limited to, those described in this agreement and in our Schedule of Fees and Charges. You authorize us to deduct all such fees and charges, without notice to you, directly from your account as accrued. You will pay any additional reasonable charges for services you request which are not covered by this agreement.

Each of you also agrees to be jointly and severally (individually) liable for any account shortage resulting from fees, charges, or overdrafts, whether caused by you or another with access to this account. This liability is due immediately, and can be deducted directly from your account even if sufficient funds are not available at the time. You have no right to defer payment of this liability, and you are liable regardless of whether you signed the item or benefited from the fee, charge, or overdraft.

You will be liable for our costs as well as for our reasonable attorneys’ fees, to the extent permitted by law, whether incurred as a result of collection or in any other dispute involving your account. This includes, but is not limited to, disputes between you and another joint owner; you and an authorized signer or similar party; or a third party claiming an interest in your account. This also includes any action that you or a third party takes regarding the account that causes us, in good faith, to seek the advice of an attorney, whether or not we become involved in the dispute. All costs and attorneys’ fees can be deducted from your account when they are incurred, without notice to you. But in the event you bring a dispute against us, you will not be responsible for our costs and attorneys' fees except as provided by applicable law.

Unless we agree in writing otherwise, we have no fiduciary duties to you related to the accounts and services we provide to you. We will not be liable for anything we do when following your instructions. We will not be liable if we do not follow your instructions if we reasonably believe that following your instructions would expose us to potential loss or civil or criminal liability or conflict with customary banking practice.

You must file any lawsuit or arbitration against us within two years after the cause of action arises, unless applicable law or an applicable provision of this agreement or any other agreement between you and us provides for a shorter time.

Deposits

Generally - We will give only provisional credit until collection and settlement are final for any items, other than cash, we accept for deposit (including items drawn “on us”). Before settlement of any item becomes final, we act only as your agent, regardless of the form of indorsement or lack of indorsement on the item and even though we provide you provisional credit for the item. We may reverse any provisional credit for items that are lost, stolen, or returned, even if the reversal causes a negative balance in your account. Unless prohibited by law, we also reserve the right to charge back to your account the amount of any item deposited to your account or cashed for you which was initially paid by the payor bank and which is later returned to us due to an allegedly forged, unauthorized or missing indorsement, claim of alteration, encoding error or other problem which in our judgment justifies reversal of credit (for example, a counterfeit cashier's check). You authorize us to attempt to collect previously returned items without giving you notice, and in attempting to collect we may permit the payor bank to hold an item beyond the midnight deadline. Unless specifically stated elsewhere in this agreement or in a separate agreement between you and us, actual credit for deposits of, or payable in, foreign currency will be in U.S. dollars based on the exchange rate in effect at the Federal Reserve Banks at the time of final collection. We are not responsible for transactions by mail or outside depository until we actually record them. If you deliver a deposit to us and you will not be present when the deposit is counted, you must provide us an itemized list of the deposit (deposit slip). To process the deposit, we will verify and record the deposit, and credit the deposit to the account. If there are any discrepancies between the amounts shown on the itemized list of the deposit and the amount we determine to be the actual deposit, we will notify you of the discrepancy. You will be entitled to credit only for the actual deposit as determined by us, regardless of what is stated on the itemized deposit slip. We will treat and record all transactions received after our “daily cutoff time” on a business day we are open, or received on a day we are not open for business, as if initiated on the next business day that we are open. If we accept a third-party check or draft for deposit, we may require any third-party indorsers to verify or guarantee their indorsements, or indorse in our presence.

Collection as Agent - We reserve the right, at our discretion, to accept an item for collection instead of deposit and to impose a fee for attempting collection of the item. If we accept an item for collection, we will not give you credit for the item until we receive actual and final payment for the item. We are obligated only to exercise ordinary care in handling and collecting items we accept for collection; you assume all other risk. We are not liable for any failure to collect or settle items accepted for collection. Items accepted for collection that are payable in foreign currency will be credited in U.S. dollars. We are not responsible for any exchange rate that any paying bank or Federal Reserve Bank uses to convert such funds. Exchange rates can fluctuate significantly in a short period of time. You bear all exchange rate risk related to items accepted for collection that are payable in foreign currency.

Early Payday - For certain eligible accounts and certain eligible direct deposits, we may make funds available to you up to two days before the scheduled effective date. Eligible direct deposits are limited to ACH credits, and may include, for example, payroll, pension, and government payments.

When funds are made available early, they will be reflected in the available balance of your account. We do not guarantee that we will make funds available early. The timing of early availability may depend on (1) when we receive the payment instructions, (2) our fraud prevention screening, and (3) other considerations (such as limits on eligible transaction size or timing) that we may impose or change at any time without notice to you.

There is no fee for Early Payday, and you do not need to enroll. Early Payday is provided at our sole discretion and is subject to change or cancellation without notice.

For interest-bearing accounts, your incoming direct deposit may not be considered part of the account’s balance for purposes of accruing interest until the business day we receive the funds from your payment provider’s bank. If a direct deposit is not made available early, it will be made available in accordance with our funds availability policy. Except as stated in this section, funds made available early are subject to the same terms and conditions as other deposits to your account.

If we make funds available early and the payment provider reduces, reverses, or requests a return of the deposit, or the funds are otherwise uncollected by us, you agree that we may debit your account up to the amount of the deposit. We can debit your account even if you have already withdrawn the funds or if the debit creates an overdraft on your account. You agree to immediately repay us the amount of any such overdraft on your account.

Withdrawals

Generally - Unless clearly indicated otherwise on your account records, any of you, acting alone, who signs to open the account or has authority to make withdrawals may withdraw or transfer all or any part of your account’s available balance at any time. Each of you (until we receive written notice to the contrary) authorizes each other person who signs or has authority to make withdrawals to indorse any item payable to you or your order for deposit to this account or any other transaction with us.

Available balance - The term “available balance” means the amount of money in your account that you can use, withdraw, or transfer. The available balance may increase or decrease throughout the day based on the account activity. Any holds associated with your account reduce the available balance.

Some activities may not cause your available balance to increase or decrease right away. For example, your available balance may not reflect (1) outstanding checks and authorized withdrawals that we have not received, (2) debit card transactions that you authorized but that have not been submitted by the merchant, (3) the final amount of a debit card purchase that has been authorized (like a car rental or hotel bill), or (4) amounts from deposits that are not yet available (see the disclosure titled “Your Ability to Withdraw Funds” for more information).

You may obtain the available balance (as of the time of your inquiry) via Simmons Online Banking, Mobile Banking, at an automated teller machine (“ATM”), at a Simmons Bank branch, or by calling us at (866) 246-2400.

Postdated checks - A postdated check is one which bears a date later than the date on which the check is written. We may properly pay and charge your account for a postdated check even though payment was made before the date of the check, unless we have received written notice of the postdating in time to have a reasonable opportunity to act. Because we process checks mechanically, your notice will not be effective and we will not be liable for failing to honor your notice unless it precisely identifies the number, date, amount and payee of the item.

Checks and withdrawal rules - If you do not purchase your check blanks from us, you must be certain that we approve the check blanks you purchase. We may refuse any withdrawal or transfer request which you attempt on forms not approved by us or by any method we do not specifically permit. We may refuse any withdrawal or transfer request which is greater in number than the frequency permitted, or which is for an amount greater or less than any withdrawal limitations. We will use the date the transaction is completed by us (as opposed to the date you initiate it) to apply the frequency limitations. In addition, we may place limitations on the account until your identity is verified. Even if we honor a nonconforming request, we are not required to do so later. If you violate the stated transaction limitations (if any), in our discretion we may close your account or reclassify it as a transaction account. If we reclassify your account, your account will be subject to the fees and earnings rules of the new account classification.

If we are presented with an item drawn against your account that would be a “substitute check,” as defined by law, but for an error or defect in the item introduced in the substitute check creation process, you agree that we may pay such item.

See the funds availability policy disclosure for information about when you can withdraw funds you deposit. For those accounts to which our funds availability policy disclosure does not apply, you can ask us when you make a deposit when those funds will be available for withdrawal. An item may be returned after the funds from the deposit of that item are made available for withdrawal. In that case, we will reverse the credit of the item. We may determine the available balance in your account for the purpose of deciding whether to return an item for insufficient funds at any time between the time we receive the item and when we return the item or send a notice in lieu of return. We need only make one determination, but if we choose to make a subsequent determination, the available balance at the subsequent time will determine whether there are insufficient funds.

Cash withdrawals - We recommend you take care when making large cash withdrawals because carrying large amounts of cash may pose a danger to your personal safety. As an alternative to making a large cash withdrawal, you may want to consider a cashier's check or similar instrument. You assume full responsibility of any loss in the event the cash you withdraw is lost, stolen, or destroyed. You agree to hold us harmless from any loss you incur as a result of your decision to withdraw funds in the form of cash.

Overdrafts and Returned Items-

Generally -- When the dollar amount of an item presented to us for payment exceeds the applicable available balance (as defined below) of your account, at our discretion and without notice to you, we may pay or return the item. If we pay the item, the payment can result in a negative available balance on your account and create an overdraft. We may decide to pay an item even if the applicable available balance of your account is already negative. Each such payment will constitute an additional overdraft. An item may include a check, ACH debit, ATM debit, debit card transaction, bank fee or other item or debit.

The fact that, in the past, we may have paid items that created overdrafts or returned items that would have overdrawn your account does not obligate us to do the same in the future. You CANNOT rely on us to pay overdrafts on your account regardless of how frequently or under what circumstances we have paid overdrafts on your account in the past. We can change our practice of paying overdrafts on your account without notice to you.

For an ATM withdrawal or point-of-sale (non-recurring) debit card transaction, we will conduct an analysis of whether to pay (authorize) the item at the time of the transaction. If this analysis results in a decision not to pay the item, then the transaction will be declined (or partially declined).

For all other items, we conduct an initial automated analysis of each item when the item is first included in nightly processing for posting to your account (the “initial automated analysis”). If the initial automated analysis results in a decision to pay the item, then the item will be processed and posted to your account during that nightly processing (see the “Posting Order” section below for more information on our posting process). If the initial automated analysis is unable to determine whether to pay or return the item, then we conduct a manual analysis of the item on the following business day. If, after the manual analysis, we decide to pay the item in our discretion, then the item will be processed and posted to your account during the nightly processing for that business day (i.e., the business day on which the manual decision was made); however, as described below, for purposes of determining whether an overdraft fee will be assessed for the item, the applicable available balance will be used.

Fees – Except as stated below, you agree that we may charge fees if we pay an item that exceeds the applicable available balance of your account. All fees for overdrafts will reduce your available balance and, if your available balance is negative, will reduce your available overdraft limit (if any).

If We Pay an Item -- If we pay an item that results in an overdraft on your account based on the applicable available balance (including a second or subsequent request for payment), we may charge a Paid Item/Overdraft Fee. However, the following exceptions apply:

- We generally will not charge a Paid Item/Overdraft Fee for an item that results in an available balance that is negative by $5.00 or less.

- For consumer accounts only, we will not charge Paid Item/Overdraft Fees for overdrafts caused by ATM withdrawals or point-of-sale (non-recurring) debit card transactions if you have not opted into our Additional Overdraft Privilege program, which is optional.

- We will not charge a Paid Item/Overdraft Fee for ATM or point-of-sale (non-recurring) debit card transactions if the available balance at the time of the transaction was sufficient to cover the authorized amount.

If We Return an Item -- If we return an item that would have resulted in an overdraft on your account had the item been paid during our posting process (including a second or subsequent request for payment), we will not charge you a fee for returning the item. However, you may be charged a fee by the party that presented the item for payment.

Additional Information -- More information about returned items, overdraft services, and fees for overdrafts can be found in our Overdraft Privilege Disclosure, the disclosure titled “What you Need to Know about Overdrafts and Overdraft Fees”, and our Schedule of Fees and Charges. Additional copies of each of these documents are available from us upon request. You can also ask us if we have other account services that might be available to you where we agree to pay overdrafts under certain circumstances, such as an overdraft protection line-of-credit or a plan to sweep funds from another account you have with us.

Repaying Overdrafts -- You agree to immediately repay us the amount of any overdraft on your account. If you do not do so, or if you have too many overdrafts, we may close your account. Also, we may report to consumer reporting agencies your overdrafts and your failure to repay them, and we may commence collection activities (in addition to any other legal remedy we may have).

Multiple Requests for Payment -- If we return an item, the party that presented the item for payment might have the right to make a second or subsequent request for payment. If we receive such a second or subsequent request for payment, we will treat the request as an independent item different from the item(s) previously presented. This means that if a second or subsequent request for payment is made, and at that time it again exceeds the applicable available balance on your account, we may either pay or return the item and if we pay the item, then we may charge a Paid Item/Overdraft Fee.

“Applicable Available Balance” – The “applicable available balance” is:

- except as described in parts (2) and (3) below, the available balance of your account immediately prior to the time that the item is processed and posted to your account;

- for an item that requires a manual analysis as described above, the available balance of your account at the time the initial automated analysis was conducted (this is generally during the nightly processing that occurs the immediately preceding business day before the manual analysis occurs); or

- for ATM withdrawals and point-of-sale (non-recurring) debit card transactions:

- except as described in subpart b below, the available balance of your account at the time of the transaction; and

- only for purposes of the subsection above titled “Fees”, the available balance of your account immediately prior to the time that the item is processed and posted to your account.

Multiple signatures, electronic check conversion, and similar transactions - An electronic check conversion transaction is a transaction where a check or similar item is converted into an electronic fund transfer as defined in the Electronic Fund Transfers regulation. In these types of transactions the check or similar item is either removed from circulation (truncated) or given back to you. As a result, we have no opportunity to review the signatures or otherwise examine the original check or item. You agree that, as to these or any items as to which we have no opportunity to examine the signatures, you waive any requirement of multiple signatures.

Notice of withdrawal - We reserve the right to require not less than 7 days’ notice in writing before each withdrawal from an interest-bearing account other than a time deposit or demand deposit, or from any other savings account as defined by Regulation D. (The law requires us to reserve this right, but it is not our general policy to use it.) Withdrawals from a time account prior to maturity or prior to any notice period may be restricted and may be subject to penalty. See your notice of penalty for early withdrawal.

Posting Order

Posting order is the order in which we post transactions to your account. When we transition from one business day to the next business day, we post transactions to your account during our nightly processing for each business day. In connection with the posting process, we generally group transactions into two main categories: debits and credits. Within the debit and credit categories, we further generally subcategorize and post transactions by category/subcategory.

- Deposits and other categories of credits are generally posted before debits.

- Withdrawals and other categories of debits are generally posted after credits. Among the debit categories, categories of electronic transactions, such as ATM withdrawals, PIN-based debit card transactions, and signature-based debit card transactions, are generally posted before categories of paper items, such as checks. Within each category of electronic debit transactions, we generally post transactions based on the dollar amount, from lowest to highest. Within each category of checks and other paper items, we generally post in check/item number order.

- We generally post Paid Item/Overdraft Fees immediately after we post the debit item that exceeded the applicable available balance.

- We generally post service charges last.

A transaction may affect the available balance of your account prior to the time it is posted to your account. For example, when a debit card transaction is authorized, the authorization may reduce the available balance on your account in an amount equal to the authorization.

Ownership of Account and Beneficiary Designation

These rules apply to this account depending on the form of ownership and beneficiary designation, if any, specified on the account records. We make no representations as to the appropriateness or effect of the ownership and beneficiary designations, except as they determine to whom we pay the account funds.

Individual Account - is an account in the name of one person.

Joint Account - With Survivorship (And Not As Tenants In Common) - is an account in the name of two or more persons. Each of you intend that when you die, the funds in the account (subject to any previous pledge to which we have agreed) will belong to the survivor(s). If two or more of you survive, you will own the funds in the account as joint tenants with survivorship and not as tenants in common.

Joint Account - No Survivorship (As Tenants In Common) - is owned by two or more persons, but none of you intend (merely by opening this account) to create any right of survivorship in any other person. We encourage you to agree and tell us in writing of the percentage of the deposit contributed by each of you. This information will not, however, affect the “number of signatures” necessary for withdrawal.

Pay-On-Death Account – You may create a Pay-On-Death account by designating one or more Pay-On-Death beneficiaries. If two or more of you create such an account, all of you own the account jointly with survivorship. Beneficiaries cannot withdraw unless: (1) all persons creating the account die, and (2) the beneficiary is living when the last person who created the account dies. If two or more beneficiaries are named and survive the death of all persons creating the account, such beneficiaries will own this account in equal shares, with right of survivorship. The person(s) creating this account type reserves the right to: (1) change beneficiaries, (2) change account types, and (3) withdraw all or part of the account funds at any time.

Business, Organization and Association Accounts

Earnings in the form of interest, dividends, or credits will be paid only on collected funds, unless otherwise provided by law or our policy. You represent that you have the authority to open and conduct business on this account on behalf of the entity. We may require the governing body of the entity opening the account to give us a separate authorization telling us who is authorized to act on its behalf. We will honor the authorization until we actually receive written notice of a change from the governing body of the entity.

Stop Payments

The rules in this section cover stopping payment of items such as checks and drafts. Rules for stopping payment of other types of transfers of funds, such as consumer electronic fund transfers, may be established by law or our policy. Additional information about stopping a pre-authorized payment can be found by referring to your Electronic Fund Transfers disclosure and the subsection titled “Right to Stop Payment and Procedure for Doing So” in the section titled “Preauthorized Payments".

We may accept an order to stop payment on any item from any one of you. You must make any stop-payment order in the manner required by law and we must receive it in time to give us a reasonable opportunity to act on it before our stop-payment cutoff time. Because stop-payment orders are handled by computers, to be effective, your stop-payment order must precisely identify the number, date, and amount of the item, and the payee. You may stop payment on any item drawn on your account whether you sign the item or not. In general, your stop-payment order - whether we receive it orally, in writing, or by another type of record - will be effective for six months. We will send you confirmation - either in writing or by another type of record - of your stop-payment order which will include the date on which your stop-payment order will lapse. (Generally, a “record” is information that is stored in such a way that it can be retrieved and can be heard or read and understood). We may rely on the information in that confirmation unless you notify us immediately of any errors. We are not obligated to notify you when a stop-payment order expires. However, you can prevent your stop-payment order from expiring by renewing your stop-payment order before the end of the six-month period.

If you stop payment on an item and we incur any damages or expenses because of the stop payment, you agree to indemnify us for those damages or expenses, including attorneys’ fees. You assign to us all rights against the payee or any other holder of the item. You agree to cooperate with us in any legal actions that we may take against such persons. You should be aware that anyone holding the item may be entitled to enforce payment against you despite the stop-payment order.

Our stop-payment cutoff time is one hour after the opening of the next banking day after the banking day on which we receive the item. Additional limitations on our obligation to stop payment are provided by law (e.g., we paid the item in cash or we certified the item).

Telephone Transfers

A telephone transfer of funds from this account to another account with us, if otherwise arranged for or permitted, may be made by the same persons and under the same conditions generally applicable to withdrawals made in writing. Limitations on the number of telephonic transfers from a savings account, if any, are described elsewhere.

Amendments and Termination

We may change this agreement at any time, including by adding new terms or by deleting or amending then-existing terms. Rules governing changes in interest rates are provided separately in the Truth-in-Savings disclosure or in another document. For other changes, we will give you reasonable notice in writing or by any other method permitted by law.

We may close this account at any time without prior notice to you. If we close your account, we will provide reasonable notice to you and tender the funds in the account personally or by mail. Items presented for payment after the account is closed may be dishonored, and we have no liability for such dishonor. When you are closing your account, you are responsible for leaving enough money in the account to cover any outstanding items to be paid from the account. Reasonable notice depends on the circumstances, and in some cases such as when we cannot verify your identity or we suspect fraud, it might be reasonable for us to give you notice after the change or account closure becomes effective. For instance, if we suspect fraudulent activity with respect to your account, we might immediately freeze or close your account and then give you notice. If we have notified you of a change in any term of your account (including, for the avoidance of doubt, a change to this agreement) and you continue to have your account after the effective date of the change, you have agreed to the new term(s).

Notices

Any written notice you give us is effective when we actually receive it, and it must be given to us according to the specific delivery instructions provided elsewhere, if any. We must receive it in time to have a reasonable opportunity to act on it. If the notice is regarding a check or other item, you must give us sufficient information to be able to identify the check or item, including the precise check or item number, amount, date and payee. Written notice we give you is effective when it is deposited in the United States Mail with proper postage and addressed to your mailing address we have on file, or, if you have consented to receive notices from us electronically, when it is first made available to you electronically. Notice to any of you is notice to all of you.

Statements

Your duty to report unauthorized signatures, alterations and forgeries - You must examine your statement of account with “reasonable promptness.” If you discover (or reasonably should have discovered) any unauthorized signatures or alterations, you must promptly notify us of the relevant facts. As between you and us, if you fail to do either of these duties, you will have to either share the loss with us, or bear the loss entirely yourself (depending on whether we used ordinary care and, if not, whether we substantially contributed to the loss). The loss could be not only with respect to items on the statement but other items with unauthorized signatures or alterations by the same wrongdoer.

You agree that the time you have to examine your statement and report to us pursuant to this section will depend on the circumstances, but will not, except as provided in the next paragraph, exceed a total of 30 days from when the statement is first sent or made available to you. If you fail to report any unauthorized signatures, alterations or forgeries in your account within 30 days of when we first send or make the statement available to you, you cannot assert a claim against us on any items in that statement, and as between you and us the loss will be entirely yours, including, but not limited to, any amounts lost as a result of subsequent unauthorized signatures, alterations or forgeries on your account by the same wrongdoer if the payment was made before we received notice from you.

You further agree that, if we did not use ordinary care, the time that you have to examine your statements and report to us pursuant to this section will be extended to 60 days. If you fail to report any unauthorized signatures, alterations or forgeries in your account within 60 days of when we first send or make the statement available, you cannot assert a claim against us on any items in that statement, and as between you and us the loss will be entirely yours. The limitation in this paragraph is in addition to (and not in limitation of) that contained in the first and second paragraphs of this section.

Your duty to report other errors or problems - In addition to your duty to review your statements for unauthorized signatures, alterations and forgeries, you agree to examine your statement with reasonable promptness for any other error or problem - such as an encoding error, an unexpected deposit amount, or an improper fee or charge. In addition, if you receive or we make available either your items or images of your items, you must examine them for any unauthorized or missing indorsements or any other problems. You agree that the time you have to examine your statement and items and report to us will depend on the circumstances. However, this time period shall not exceed 60 days. Failure to examine your statement and items and report any errors or problems to us within 60 days of when we first send or make the statement available precludes you from asserting a claim against us for any errors or problems related to items or other matters identified in that statement and as between you and us the loss will be entirely yours.

Duty to notify if statement not received - You agree to immediately notify us if you do not receive your statement by the date you normally expect to receive it. Not receiving your statement in a timely manner is a sign that there may be an issue with your account, such as possible fraud or identity theft.

Errors relating to electronic fund transfers or substitute checks – This paragraph applies to consumer accounts only. For information on errors relating to consumer electronic fund transfers governed by Regulation E refer to your Electronic Fund Transfers disclosure and the sections on consumer liability and error resolution. For information on errors relating to a substitute check you received, refer to your disclosure entitled Substitute Checks and Your Rights.

Account Transfer

This account may not be transferred or assigned without our prior written consent.

Direct Deposits

If we are required for any reason to reimburse the federal government for all or any portion of a benefit payment that was directly deposited into your account, you authorize us to deduct the amount of our liability to the federal government from the account or from any other account you have with us, without prior notice and at any time, except as prohibited by law. We may also use any other legal remedy to recover the amount of our liability.

Temporary Account Agreement

If the account documentation indicates that this is a temporary account agreement, each person who signs to open the account or has authority to make withdrawals (except as indicated to the contrary) may transact business on this account. However, we may at some time in the future restrict or prohibit further use of this account if you fail to comply with the requirements we have imposed within a reasonable time.

Setoff; Security Interest

You grant us a right of setoff to, and a security interest in, your account to ensure you pay us all amounts you owe us under this agreement or other debts you owe us (now or in the future). By opening and maintaining your account with us, you consent to our asserting our security interest in your account, to the extent any applicable laws require your consent. Our rights under this security interest are in addition to, and not in limitation of, any other rights under any other security interest you may have granted to us under a separate agreement.

We may (without prior notice and when permitted by law) set off the funds in this account against any due and payable debt any of you owe us now or in the future. If this account is owned by one or more of you as individuals, we may set off any funds in the account against (i) any due and payable debt owed to us by any account owner or (ii) any due and payable debt a partnership owes us now or in the future, to the extent of your liability as a partner for the partnership debt. If your debt arises from a promissory note, then the amount of the due and payable debt will be the full amount we have demanded, as entitled under the terms of the note, and this amount may include any portion of the balance for which we have properly accelerated the due date.

This right of setoff does not apply to this account if prohibited by law. For example, the right of setoff does not apply to this account if: (a) it is an Individual Retirement Account or similar tax-deferred account, or (b) the debt is created by a consumer credit transaction under a credit card plan (but this does not affect our rights under any consensual security interest), or (c) the debtor’s right of withdrawal only arises in a representative capacity, or (d) setoff is prohibited by the Military Lending Act or its implementing regulations. We will not be liable for the dishonor of any check when the dishonor occurs because we set off a debt against this account. You agree to hold us harmless from any claim arising as a result of our exercise of our security interest or right of setoff.

You may not grant a security interest in your account to anyone other than us without our prior written consent.

Agency (Power of Attorney) Designation

We may allow account owners to designate an agent on their account using a power of attorney. We reserve the right to review, and decline, at our discretion and to the extent allowed by applicable law, any power of attorney. If we accept a power of attorney, the agent(s) may make account transactions on behalf of the account owners. Agents have no ownership or rights at death unless also named as Pay-on-Death beneficiaries. The owner does not give up any rights to act on the account. The owner is responsible for all transactions of the agent. We undertake no obligation to monitor transactions to determine that they are on the owner’s behalf.

The owner may terminate the agency at any time, and the agency is automatically terminated by the death of the owner. However, we may continue to honor the transactions of the agent until: (a) we have received written notice or have actual knowledge of the termination of the agency, and (b) we have a reasonable opportunity to act on that notice or knowledge. We may refuse to accept the designation of an agent.

Restrictive Legends or Indorsements

The automated processing of the large volume of checks we receive prevents us from inspecting or looking for restrictive legends, restrictive indorsements or other special instructions on every check. Examples of restrictive legends placed on checks are “must be presented within 90 days” or “not valid for more than $1,000.00.” The payee’s signature accompanied by the words “for deposit only” is an example of a restrictive indorsement. For this reason, we are not required to honor any restrictive legend or indorsement or other special instruction placed on checks you write unless we have agreed in writing to the restriction or instruction. Unless we have agreed in writing, we are not responsible for any losses, claims, damages, or expenses that result from your placement of these restrictions or instructions on your checks.

Facsimile Signatures

Unless you make advance arrangements with us, we have no obligation to honor facsimile signatures on your checks or other orders. If we do agree to honor items containing facsimile signatures, you authorize us, at any time, to charge you for all checks, drafts, or other orders, for the payment of money, that are drawn on us. You give us this authority regardless of by whom or by what means the facsimile signature(s) may have been affixed so long as they resemble the facsimile signature specimen filed with us, and contain the required number of signatures for this purpose. You must notify us at once if you suspect that your facsimile signature is being or has been misused.

Check Processing

We process items mechanically by relying solely on the information encoded in magnetic ink along the bottom of the items. This means that we do not individually examine all of your items to determine if the item is properly completed, signed and indorsed or to determine if it contains any information other than what is encoded in magnetic ink. You agree that we have exercised ordinary care if our automated processing is consistent with general banking practice, even though we do not inspect each item. Because we do not inspect each item, if you write a check to multiple payees, we can properly pay the check regardless of the number of indorsements unless you notify us in writing that the check requires multiple indorsements. We must receive the notice in time for us to have a reasonable opportunity to act on it, and you must tell us the precise date of the check, amount, check number and payee. We are not responsible for any unauthorized signature or alteration that would not be identified by a reasonable inspection of the item. Using an automated process helps us keep costs down for you and all account holders.

Check Cashing

We may charge a fee for anyone that does not have an account with us who is cashing a check, draft or other instrument written on your account. We may also require reasonable identification to cash such a check, draft or other instrument. We can decide what identification is reasonable under the circumstances and such identification may be documentary or physical and may include collecting a thumbprint or fingerprint.

Indorsements

We may accept for deposit any item payable to you or your order, even if they are not indorsed by you. We may give cash back to any one of you. We may supply any missing indorsement(s) for any item we accept for deposit or collection, and you warrant that all indorsements are genuine.

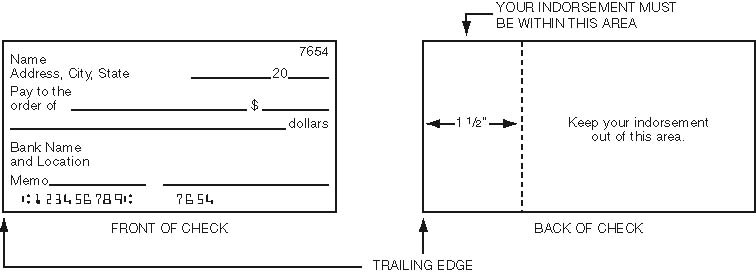

To ensure that your check or share draft is processed without delay, you must indorse it (sign it on the back) in a specific area. Your entire indorsement (whether a signature or a stamp) along with any other indorsement information (e.g. additional indorsements, ID information, driver’s license number, etc.) must fall within 11/2” of the “trailing edge” of a check. Indorsements must be made in blue or black ink, so that they are readable by automated check processing equipment.

As you look at the front of a check, the “trailing edge” is the left edge. When you flip the check over, be sure to keep all indorsement information within 11/2” of that edge.

It is important that you confine the indorsement information to this area since the remaining blank space will be used by others in the processing of the check to place additional needed indorsements and information. You agree that you will indemnify, defend, and hold us harmless for any loss, liability, damage or expense that occurs because your indorsement, another indorsement or information you have printed on the back of the check obscures our indorsement.

These indorsement guidelines apply to both personal and business checks.

Death or Incompetence

You agree to notify us promptly if any person with a right to withdraw funds from your account(s) dies or is adjudicated (determined by the appropriate official) incompetent. We may continue to honor your checks, items, and instructions until: (a) we know of your death or adjudication of incompetence, and (b) we have had a reasonable opportunity to act on that knowledge. You agree that we may pay or certify checks drawn on or before the date of death or adjudication of incompetence for up to ten (10) days after your death or adjudication of incompetence unless ordered to stop payment by someone claiming an interest in the account.

Fiduciary Accounts

Accounts may be opened by a person acting in a fiduciary capacity. A fiduciary is someone who is appointed to act on behalf of and for the benefit of another. We are not responsible for the actions of a fiduciary, including the misuse of funds. This account may be opened and maintained by a person or persons named as a trustee under a written trust agreement, or as executors, administrators, or conservators under court orders. You understand that by merely opening such an account, we are not acting in the capacity of a trustee in connection with the trust nor do we undertake any obligation to monitor or enforce the terms of the trust or letters.

Credit Verification

You agree that we may verify credit and employment history by any necessary means, including preparation of a credit report by a credit reporting agency.

Legal Actions Affecting Your Account

If we are served with a subpoena, restraining order, writ of attachment or execution, levy, garnishment, search warrant, or similar order relating to your account (termed “legal action” in this section), we may comply with that legal action. In our discretion, we may freeze or restrict the assets in the account and not allow any payments out of the account until a final court determination regarding the legal action. We may do these things even if the legal action involves less than all of you. We will not have any liability to you if there are insufficient funds to pay your items because we have withdrawn funds from your account or in any way restricted access to your funds because of the legal action. Except where limited by applicable law, any fees or expenses we incur in responding to any legal action (including, without limitation, attorneys’ fees and our internal expenses), except for an action you commence against us, may be setoff or charged against your account. (If you bring an action against us, you will not be responsible for our costs and attorneys' fees except as provided by applicable law.) The list of fees applicable to your account(s) provided elsewhere may specify additional fees that we may charge for certain legal actions.

Account Security

Duty to protect account information and methods of access - It is your responsibility to protect the account numbers and electronic access devices (e.g., an ATM card) we provide you for your account(s). Do not discuss, compare, or share information about your account number(s) with anyone unless you are willing to give them full use of your money. An account number can be used by thieves to issue an electronic debit or to encode your number on a false demand draft which looks like and functions like an authorized check. If you furnish your access device and grant actual authority to make transfers to another person (a family member or coworker, for example) who then exceeds that authority, you are liable for the transfers unless we have been notified that transfers by that person are no longer authorized.

Your account number can also be used to electronically remove money from your account, and payment can be made from your account even though you did not contact us directly and order the payment.

You must also take precaution in safeguarding your blank checks. Notify us at once if you believe your checks have been lost or stolen. As between you and us, if you are negligent in safeguarding your checks, you must bear the loss entirely yourself or share the loss with us (we may have to share some of the loss if we failed to use ordinary care and if we substantially contributed to the loss).

Warning regarding scams – You should be on the lookout for thieves and scammers who might try to impersonate us, our employees, or people known to you. Do not share your account information with someone you do not know, and be wary of anyone requesting money from you in a manner that creates false urgency. Common scams include phishing (attempts to obtain sensitive information such as account details by posing as a reputable company via email, text, or phone), fake family emergency, IRS Impostors (fake IRS tax notices or individuals impersonating IRS agents claiming you owe taxes), and romance or affinity (individuals attempt to develop a relationship with you and then request frequent or large transfer(s) of money). For additional information regarding recent and common scams, please visit the Federal Trade Commission web site at https://www.consumer.ftc.gov/features/scam-alerts. Notify us at once if you believe you are the victim of a scam and have been induced to withdraw or transfer funds from your account.

Positive pay and other fraud prevention services - Except for consumer electronic fund transfers subject to Regulation E, you agree that if we offer you services appropriate for your account to help identify and limit fraud or other unauthorized transactions against your account, and you reject those services, you will be responsible for any fraudulent or unauthorized transactions which could have been prevented by the services we offered. You will not be responsible for such transactions if we acted in bad faith or to the extent our negligence contributed to the loss. Such services include positive pay or commercially reasonable security procedures. If we offered you a commercially reasonable security procedure which you reject, you agree that you are responsible for any payment order, whether authorized or not, that we accept in compliance with an alternative security procedure that you have selected.

Telephonic Instructions

Unless required by law or we have agreed otherwise in writing, we are not required to act upon instructions you give us via facsimile transmission or leave by voice mail or on a telephone answering machine.

Monitoring and Recording Telephone Calls and Consent to Receive Communications

Subject to federal and state law, we may monitor or record telephone calls for security reasons, to maintain a record and to ensure that you receive courteous and efficient service. You consent in advance to any such recording.

To provide you with the best possible service in our ongoing business relationship for your account we may need to contact you about your account from time to time by telephone, text messaging or email. However, we must first obtain your consent to contact you about your account because we must comply with the consumer protection provisions in the federal Telephone Consumer Protection Act of 1991 (TCPA), CAN-SPAM Act and their related federal regulations and orders issued by the Federal Communications Commission (FCC).

- Your consent is limited to your account, and as authorized by applicable law and regulations.

- Your consent does not authorize us to contact you for telemarketing purposes (unless you otherwise agreed elsewhere).

With the above understandings, you authorize us to contact you regarding your account throughout its existence using any telephone numbers or email addresses that you have previously provided to us or that you may subsequently provide to us.

This consent is regardless of whether the number we use to contact you is assigned to a landline, a paging service, a cellular wireless service, a specialized mobile radio service, other radio common carrier service or any other service for which you may be charged for the call. You further authorize us, any third-party collection service collecting a debt arising from your account, or any other third-party service provider to contact you through the use of voice, voice mail and text messaging, including the use of pre-recorded or artificial voice messages and an automated dialing device.

If necessary, you may change or remove any of the telephone numbers or email addresses at any time using any reasonable means to notify us.

Claim of Loss

The following rules do not apply to a transaction or claim related to a consumer electronic fund transfer governed by Regulation E. The error resolution procedures for consumer electronic fund transfers can be found in our initial Regulation E disclosure titled, “Electronic Fund Transfers.” For other transactions or claims, if you claim a credit or refund because of a forgery, alteration, or any other unauthorized withdrawal, you agree to cooperate with us in the investigation of the loss, including giving us an affidavit containing whatever reasonable information we require concerning your account, the transaction, and the circumstances surrounding the loss. You will notify law enforcement authorities of any criminal act related to the claim of lost, missing, or stolen checks or unauthorized withdrawals. We will have a reasonable period of time to investigate the facts and circumstances surrounding any claim of loss. Unless we have acted in bad faith, we will not be liable for special or consequential damages, including loss of profits or opportunity, or for attorneys’ fees incurred by you.

You agree that you will not waive any rights you have to recover your loss against anyone who is obligated to repay, insure, or otherwise reimburse you for your loss. You will pursue your rights or, at our option, assign them to us so that we may pursue them. Our liability will be reduced by the amount you recover or are entitled to recover from these other sources.

Time Accounts: Additional Disclosures; Early Withdrawal Penalties (and involuntary withdrawals)

Any certificate of deposit terms and disclosures provided by us to you separately are intended to supplement the terms of this agreement. In the event of a conflict between the certificate of deposit terms and disclosures and the terms of the Truth-in-Savings Disclosure (both of which were provided to you with this agreement), the terms of the certificate of deposit terms and disclosures shall control. In the event of a conflict between the certificate of deposit terms and disclosures and any other provision of this agreement, the terms of this agreement shall control.

We may impose early withdrawal penalties on a withdrawal from a time account even if you don’t initiate the withdrawal. For instance, the early withdrawal penalty may be imposed if the withdrawal is caused by our setoff against funds in the account or as a result of an attachment or other legal process. We may close your account and impose the early withdrawal penalty on the entire account balance in the event of a partial early withdrawal. See your notice of penalty for early withdrawals for additional information.

Address or Name Changes

You are responsible for notifying us of any change in your address or your name. Unless we agree otherwise, change of address or name must be made in writing by at least one of the account holders. Informing us of your address or name change on a check reorder form is not sufficient. If we communicate by mail, we will generally attempt to communicate with you by use of the most recent address you have provided to us. If we receive returned mail, we may impose a service fee.

Resolving Account Disputes

If we become aware of a dispute or claim related to your account, we may, in our sole discretion, freeze your account, place a hold on your account (refuse payment or withdrawal of the funds), or take any other actions described in this section. A dispute or claim includes, but is not limited to, (1) others claiming an interest as survivors or beneficiaries of your account; (2) a claim arising by operation of law; (3) a dispute between you and another joint owner, you and an authorized signer or similar party; (4) a third party claiming an interest in your account; or (5) any other claim adverse to your own interest. A freeze or hold placed on your account may be for any period of time we believe reasonably necessary to allow a legal proceeding to determine the merits of the claim or until we receive evidence satisfactory to us that the dispute has been resolved. We may ignore instructions (such as an instruction by one account holder or authorized signer not to honor items or other withdrawal orders by another account holder or authorized signer) for the account unless all account holders or authorized signers agree to the instruction. We may require that all account holders or authorized signers sign any instruction, check, item, or other withdrawal order even though the signature card for your account allows for one signature. We may close your account or take other action related to your account that we determine to be reasonable under the circumstances even if the action is not listed here. We may seek instructions from a court of competent jurisdiction, at your expense (to the extent allowed by applicable law), regarding the ownership or control of the account. We may deposit the funds in the account with the clerk of a court in connection with an interpleader action, and, to the extent allowed by applicable law, may recover our costs, including attorney’s fees, out of the account. We will not be liable for any items that are dishonored as a consequence of placing a freeze or hold on funds in your account or taking other actions described in this section.

Waiver of Notices

To the extent permitted by law, you waive any notice of non-payment, dishonor or protest regarding any items credited to or charged against your account. For example, if you deposit a check and it is returned unpaid or we receive a notice of nonpayment, we do not have to notify you unless required by federal Regulation CC or other law.

ACH and Wire Transfers

Generally – Unless you have entered into a separate agreement with us that specifically governs certain funds transfers, payment orders that you give to us for the transfer of funds out of your account by wire transfer, ACH or otherwise, and payment orders that we receive for the transfer of funds into your account, will be governed by this section. If you have entered into a separate agreement with us that specifically governs certain funds transfers, then such funds transfers will be governed by that separate agreement.

Except as otherwise specified in this agreement (or, if applicable, another agreement between you and us) or to the extent required by applicable law (such as Regulation E), your and our rights and obligations with respect to a payment order will be governed by Article 4A of the Uniform Commercial Code (“UCC4A”) as enacted in Arkansas or as set forth in Regulation J, as applicable. The terms “funds transfer,” “funds-transfer system,” “payment order,” and “beneficiary” used in this section have the same definitions provided in UCC4A. We may use any means of transmission, funds-transfer system, clearing house, or intermediary bank that we select, and payment orders will be subject to the rules of those systems.

All actions and disputes concerning payment orders for the transfer of funds into or out of your account, including with respect to the authorization or cancellation of such orders, shall be determined pursuant to UCC4A and this agreement (or if applicable, another agreement between you and us) to the fullest extent permitted by applicable law. For consumer accounts, some funds transfers referenced in this section may also be electronic funds transfers that are subject to Subpart A of Regulation E, and for such transfers, Regulation E (to the extent applicable) and the terms in your Electronic Fund Transfers disclosure control in the event of a conflict with this section.

Security Procedures – You agree to comply with any security procedures we may establish for receiving and verifying payment orders, and you agree such security procedures are a commercially reasonable method of providing security against unauthorized payment orders. You agree to be bound by any payment order that we accept in accordance with any such security procedure, and you agree that such payment order will be deemed to be authorized by you and effective as to you, and we are entitled to accept and act on any such payment order, even if the payment order was not, in fact, authorized by you.

Payment Orders – We must receive payment orders not later than a specific time we may establish, from time to time, in order for the payment order to be accepted on that day. If we receive a payment order after such hour, we may either treat it as if it were received before that hour or we may treat it as received at the opening of the next business day.

You could lose funds if you provide incomplete or inaccurate information in your payment orders. We have no obligation to detect errors you make in payment orders (for example, paying the wrong person or the wrong amount). We will rely on the beneficiary account number and beneficiary bank identification number (e.g., IBAN, RTN, or SWIFT BIC) you provide with an instruction or payment order. If a payment order or cancellation identifies the beneficiary by both (i) name and (ii) an identifying number (including a bank routing and/or bank account number), and the name and number identify different persons, then execution of the payment order, payment to the beneficiary, or cancellation may be based solely on the identifying number. If a payment order identifies an intermediary bank or the beneficiary bank by both name and an identifying number, and the name and number identify different banks, then execution of the payment order by any bank may be based solely on the identifying number.

We may refuse to accept any payment order for any reason, in our discretion, and a payment order is only accepted when we execute the payment order. We will give you notice of the acceptance of a payment order by posting the amount of the payment order to your account.

Wire Transfers – When you submit a payment order that is a wire transfer denominated in U.S. dollars to a beneficiary in a foreign country, you acknowledge that the beneficiary's bank (or an intermediary bank) may convert your payment into foreign currency, and we may be compensated for such transaction. We are not responsible for any exchange rate that any beneficiary or intermediary bank uses to convert such funds. Exchange rates can fluctuate significantly in a short period of time. You bear all exchange rate risk related to payments you authorize in U.S. dollars to a beneficiary in a foreign country that will, or may be, converted to foreign currency. Returned payments are subject to the exchange rate in effect at the time of the return and may be more or less than the original payment amount.

If the beneficiary bank is located within the United States and the outgoing wire transfer is to be paid in U.S. dollars, you may request to cancel the wire transfer before it is executed (although we cannot guarantee the cancellation will be effected), but you may not amend or modify the wire transfer. We must receive your cancellation request within a reasonable time prior to the time we execute the outgoing wire transfer. Other outgoing wire transfers may not be canceled, amended, or modified.

Any credit we give you for an incoming wire transfer is provisional until we receive final settlement for the wire transfer. Incoming wire transfers received in foreign currency for payment into your account will be converted into U.S. dollars by us or an intermediary bank using the exchange rate in effect at the time the incoming wire transfer is received.

You must exercise ordinary care to determine if any funds transfer to or from your account is either unauthorized or erroneous. You must notify us of the facts within a reasonable time, not exceeding 14 days after (i) you have received your account statement from us on which the funds transfer appears or (ii) you otherwise have notice of the funds transfer, whichever is earlier. If you don’t notify us within 14 days, you are precluded from asserting that we are not entitled to retain payment for the funds transfer.

Wire transfers are fast and payments made by wire transfer are final (i.e., they cannot be reversed). For these reasons, they are also a target for scams and fraud. Your financial security is important to us, and we encourage you to take the following steps, among others, to reduce your risk when sending wire transfers: (a) do not send funds to an individual or business you do not know or have not met personally; (b) independently verify and confirm (whether in-person or through a trusted third-party) the legitimacy of what you are paying for; and (c) be cautious of any recipient claiming urgency and do not allow yourself to be rushed into initiating a wire transfer. Notify us at once if you believe you may have been a victim of a wire transfer scam.

ACH Transfers - For payment orders paid from or received by your account through the automated clearing house (ACH), you agree to be bound by automated clearing house association rules, which are available from us on request or from Nacha’s website. These rules provide, among other things, that payments made to you, or originated by you, are provisional until final settlement is made through a Federal Reserve Bank or payment is otherwise made as provided in Article 4A-403(a) of the Uniform Commercial Code. If we do not receive such payment, we are entitled to a refund from you in the amount credited to your account and the party originating such payment will not be considered to have paid the amount so credited. Credit entries may be made by ACH.

No Notice of Credit - If we receive a payment order to credit an account you have with us by wire or ACH, we are not required to give you any notice of the payment order or credit.

Truncation, Substitute Checks, and Other Check Images

If you truncate an original check and create a substitute check, or other paper or electronic image of the original check, you warrant that no one will be asked to make payment on the original check, a substitute check or any other electronic or paper image, if the payment obligation relating to the original check has already been paid. You also warrant that any substitute check you create conforms to the legal requirements and generally accepted specifications for substitute checks. You agree to retain the original check in conformance with our internal policy for retaining original checks. You agree to indemnify us for any loss we may incur as a result of any truncated check transaction you initiate. We can refuse to accept substitute checks that have not previously been warranted by a bank or other financial institution in conformance with the Check 21 Act. Unless specifically stated in a separate agreement between you and us, we do not have to accept any other electronic or paper image of an original check.

Remotely Created Checks

Like any standard check or draft, a remotely created check (sometimes called a telecheck, preauthorized draft or demand draft) is a check or draft that can be used to withdraw money from an account. Unlike a typical check or draft, however, a remotely created check is not issued by the paying bank and does not contain the signature of the account owner (or a signature purported to be the signature of the account owner). In place of a signature, the check usually has a statement that the owner authorized the check or has the owner’s name typed or printed on the signature line.

You warrant and agree to the following for every remotely created check we receive from you for deposit or collection: (1) you have received express and verifiable authorization to create the check in the amount and to the payee that appears on the check; (2) you will maintain proof of the authorization for at least 2 years from the date of the authorization, and supply us the proof if we ask; and (3) if a check is returned you owe us the amount of the check, regardless of when the check is returned. We may take funds from your account to pay the amount you owe us, and if there are insufficient funds in your account, you still owe us the remaining balance.

Unlawful Internet Gambling Notice

Restricted transactions as defined in Federal Reserve Regulation GG are prohibited from being processed through this account or relationship. Restricted transactions generally include, but are not limited to, those in which credit, electronic fund transfers, checks, or drafts are knowingly accepted by gambling businesses in connection with the participation by others in unlawful Internet gambling.

Subaccount Organization

This section applies to all transaction accounts, such as checking accounts, and does not apply to savings accounts, time deposits or money market accounts. For purposes of this section, Health Savings Accounts are considered transaction accounts. We have organized your account in a nontraditional way. Your account consists of two subaccounts. One of these accounts is a transaction subaccount (e.g., a checking subaccount). You will transact business on this subaccount. The other is a nontransaction subaccount (e.g., a savings account). You cannot directly access the nontransaction subaccount, but you agree that we may automatically, and without a specific request from you, initiate individual transfers of funds between subaccounts from time to time at no cost to you. This account organization will not change the amount of federal deposit insurance available to you, your available balance, the information on your periodic statements, or the interest calculation, if this is an interest-bearing account. You will not see any difference between the way your account operates and the way a traditionally organized account operates, but this organization makes us more efficient.

Dispute Resolution by Binding Arbitration

This arbitration provision is optional. If you do not wish to accept it, you must follow the instructions in paragraph (9) below to reject arbitration. Unless you timely reject arbitration, this arbitration provision is binding on you and us.

(1) Claims Subject to Arbitration: Except as specified in paragraph (2) below, any dispute or claim between you and us must be arbitrated if either party elects arbitration of that dispute or claim. This agreement to arbitrate is intended to be broadly interpreted. It includes, but is not limited to:

- claims arising out of or relating to any aspect of the relationship between you and us, whether based in contract, tort, fraud, misrepresentation, or any other statutory or common-law legal theory;

- claims that arose before this or any prior agreement (including, but not limited to, claims relating to advertising or disclosures for any of our products or services);

- claims for mental or emotional distress or injury not arising out of bodily injury;

- claims asserted in a court of general jurisdiction against you or us, including counterclaims, cross-claims, or third-party claims, that you or we elect to arbitrate;

- claims relating to the retention, protection, use, or transfer of information about you or any of your accounts for any of our products or services;

- claims relating to communications with you, regardless of sender, concerning any of our products or services, including emails and automatically dialed calls and text messages;

- claims that are currently the subject of purported class action litigation in which you are not a member of a certified class; and

- claims that may arise after the termination of this agreement.

In this arbitration provision only, references to “we”, “us”, and “our” mean the financial institution and its parents, subsidiaries, affiliates, predecessors, successors, and assigns, as well as each of those entities’ agents and employees. In this arbitration provision only, references to “you” and “your” mean the account owners, all authorized or unauthorized users or beneficiaries of the account, each of those person’s assignees, heirs, trustees, agents, or other representatives, and if the account owner is a business, the account owner’s parents, subsidiaries, affiliates, predecessors, successors, assigns, and each of those entities’ agents and employees. This arbitration agreement does not preclude you or us from bringing issues to the attention of federal, state, or local agencies. Such agencies can, if the law allows, seek relief against you or us on the other’s behalf. Nor does this arbitration agreement preclude either you or us from exercising self-help remedies (including setoff), and exercising such a remedy is not a waiver of the right to invoke arbitration of any dispute. You and we each waive the right to a trial by jury or to participate in a class action whenever either you or we elect arbitration. This agreement evidences a transaction in interstate commerce, and thus the Federal Arbitration Act governs the interpretation and enforcement of this provision. This arbitration provision shall survive termination of this agreement.

(2) Claims Not Subject to Arbitration: You and we agree that the following disputes or claims cannot be arbitrated:

- claims arising from bodily injury or death;

- claims seeking only individualized relief asserted by you or us in small claims court, so long as the action remains in that court and is not removed or appealed to a court of general jurisdiction, in which case either party may elect arbitration;

- claims to collect or challenge debts owed pursuant to an extension of credit under a separate agreement or note (such as a separate loan agreement, promissory note, or bank card agreement), in which case the dispute over the debt shall be governed by the dispute-resolution procedures set forth in that separate agreement or note; and

- disputes over the scope and enforceability of this arbitration provision or whether a dispute or claim can or must be brought in arbitration.

These exclusions from arbitration are intended to be interpreted narrowly. Excluded claims must be resolved by a court with jurisdiction.

(3) Pre-Arbitration Notice of Disputes and Informal Settlement Conference: Before either you or we commence arbitration, the claimant must first send to the other a written Notice of Dispute (“Notice”). The Notice to us should be sent to: Legal Department, Simmons Bank, P.O. Box 7009, Pine Bluff, Arkansas 71611-7009 (“Notice Address”). The Notice to you will be sent to your address on file with your account. The Notice must include: (a) the claimant’s name, mailing address, email address (if any), and phone number (if any); (b) the account number(s) at issue; (c) a description of the underlying facts and basis of the claim or dispute; and (d) the specific relief sought. The Notice must be personally signed by you (if you are the claimant) or by our representative (if we are the claimant). To help safeguard your account, if you have retained a lawyer to submit your Notice, you must also provide with the Notice your personally signed written authorization allowing us to discuss the Notice, the dispute, and your account(s) with your lawyer (“Attorney Authorization”). After receipt of the Notice, we may ask you to verify your identity and/or the fact that you authorized submission of the Notice or disclosure of account information to your lawyer (“Verification”). You agree to cooperate with any reasonable request for Verification.