Frequently Asked Questions

At Simmons Bank, the security and privacy of your financial information is our highest priority. Simmons Bank online and mobile banking utilizes several features to help protect your privacy:

- Securing your information with industry-leading encryption

- Two-factor authentication

- Automatic sign-off after a period of inactivity

- Ongoing and proactive fraud monitoring

For increased security and privacy, you should take the necessary precautions to keep your login credentials safe, keep virus/malware protection software running and up-to-date, and notify Simmons Bank immediately if you suspect any fraudulent activity.

Yes, for your convenience your login credentials are the same for Simmons Bank Mobile and Simmons Bank Online.

082900432

Click here to enroll in Simmons Bank Online.

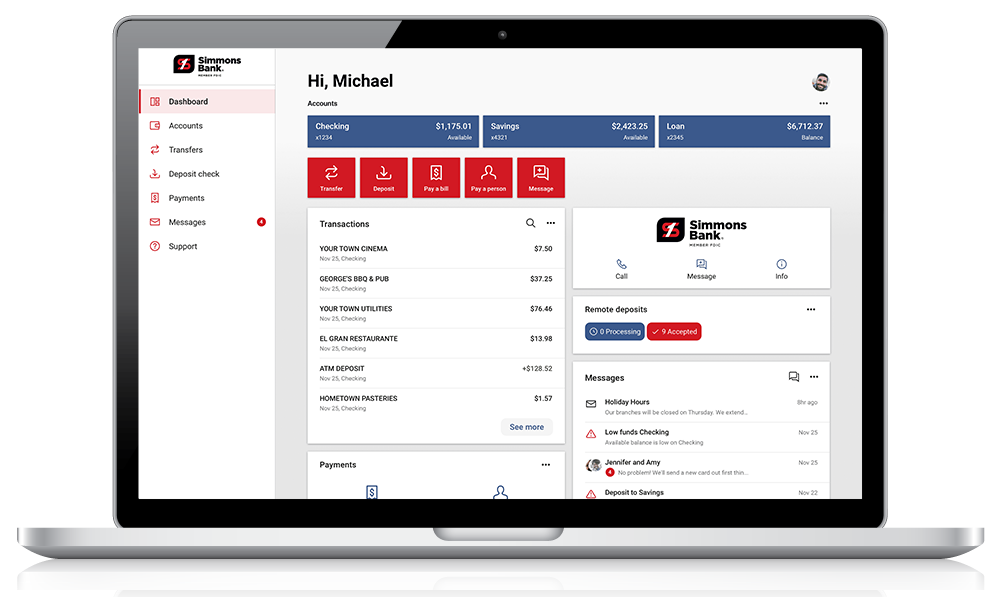

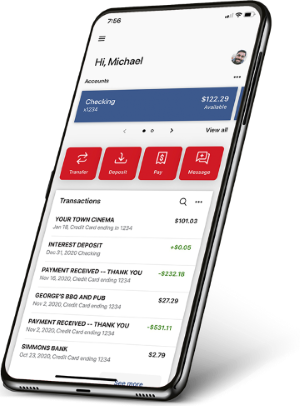

With Simmons Bank Online & Mobile Banking you can securely access your accounts 24/7 from anywhere. Take advantage of these features (and more) when you enroll in online and mobile banking:

- Monitor your accounts

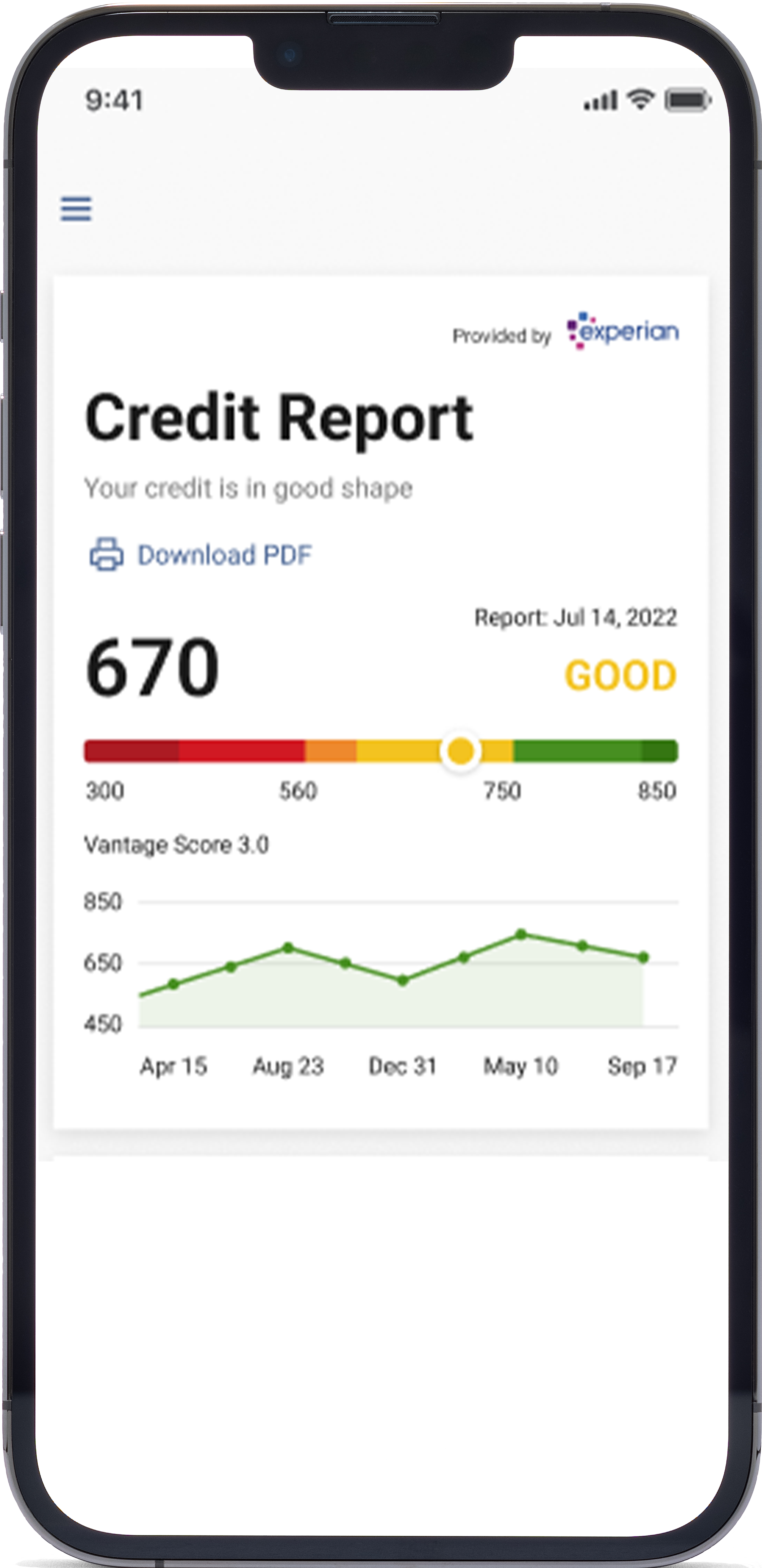

- Manage your credit score

- Pay bills

- Transfer funds

- Send money with Zelle®

- Setup card controls

- Deposit checks

- Send secure messages

At login, select “Forgot?” and follow the instructions on the screen to reset your password.

If you can login, you can send secure support messages through the Messages feature within Simmons Bank Online & Mobile. You may also contact Simmons Bank Customer Support toll free at 1-866-246-2400 between 7:30 a.m. CT and 6:00 p.m. CT each banking day, and 8:00 a.m. CT to noon CT on Saturday.

-

{97} Benefits and features are subject to customer qualification and approval by Simmons Bank.

-

{165} All accounts subject to approval. Restrictions apply.

-

{16} Data connection required. Wireless carrier fees may apply. Mobile deposit is available to Simmons Bank online and mobile banking customers who are at least 18 years of age and have the most recent Simmons Bank App for iPhone®, iPad®, or Android™.

-

{201} Receive 0.25% over the Coin Savings account’s base interest rate when Relationship Premium A requirements are met or 0.50% over the Coin Savings account’s base interest rate when Relationship Premium B requirements are met. Relationship Premium A requirements: (i) have at least one linked Coin Checking account, and (ii) make a combined minimum of 15 purchase transactions (ATM and other cash withdrawal transactions are excluded), using debit card(s) of the linked Coin Checking account(s), that settle and post to the account(s) on or before the last business day of the month preceding the end of the Coin Savings account statement cycle to which the Relationship Premium will apply. Relationship Premium B requirements: (i) meet both Relationship Premium A requirements, and (ii) have a combined minimum of $500 in ACH transactions deposited into your linked Coin Checking account(s) that settle and post on or before the last business day of the month preceding the end of the Coin Savings account statement cycle to which the Relationship Premium will apply. To be linked, a Coin Checking account must have the same primary account holder as the Coin Savings account. Relationship Premiums will only be paid on Coin Savings account balances up to and including $10,000. Any remaining balances in the account will be paid the base interest rate. Pending transactions are not settled and posted. Only one Coin Savings account per account holder may be eligible for Relationship Premiums; if you have multiple open Coin Savings accounts, Relationship Premiums will only apply to the most recently opened account. Your Coin Savings and Coin Checking accounts are subject to other terms and conditions.

-

{19} iPhone, iPad, Apple, and the Apple Logo are registered trademarks of Apple Inc.

-

{108} Android, Google Play, and the Google Play logo are trademarks of Google LLC.

-

{171} Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.