Choose your account.

Open Online.

MOST POPULAR

Simply Checking

Keep it simple and budget-friendly.

- Great for first-time account holders

- $0 monthly service charge

SPEND + EARN

Coin Checking + Savings

Choose the checking and savings accounts that work together.

- $0 monthly service charge

- Earn extra interest when you bundle Coin Checking with a Coin Savings account{201}

COMPLIMENTARY CHECKS

Classic Checking

Enjoy traditional banking.

- Standard checks included at no cost

- $6 monthly service charge; waived if you maintain a $500 daily balance or a $1,000 average monthly balance

DIGITAL - FIRST

Coin Checking

It’s your coin. Keep all of it.

- $0 monthly service charge

- Get your paycheck up to 2 days early with Early Payday{213}

- Pair with Coin Savings for additional savings benefits{201}

Get your paycheck early.

With Early Payday, direct deposits may be posted to your account up to 2 days early!{213}

There’s no fee and no need to sign up.

Don't have direct deposit? No problem! Download this form and submit to your employer, to request to get started.

Call 877-245-1234 for deposits and loans, or 800-272-2102 for credit cards to access your account any time.

Round up your purchases to the next whole dollar amount and we'll deposit the difference in a second account of your choice.{21}

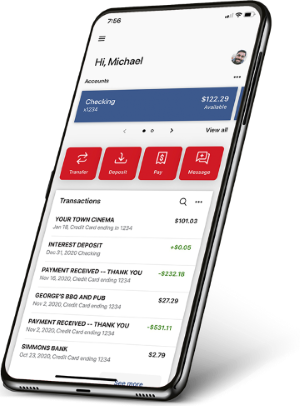

Save a trip to the bank. Deposit checks from your smartphone or tablet anytime, anywhere with no charge.{16}

Frequently asked questions:

We currently offer online opening for the following products:

To open a checking or savings account, you will need a valid state-issued ID, your SSN, and a computer or mobile device with a camera.

To open a Certificate of Deposit (CD) online, you'll need a valid state-issued ID, a minimum opening deposit of $5,000 or $50,000 that is new money*, login credentials for the external bank account you plan to use to fund your new CD account, and the name, address, and SSN for your beneficiary should you wish to designate one. You will need a copmuter or mobile device with a camera to open this account.

*New money is money that is not currently on deposit at Simmons Bank.

If you are already a Simmons Bank customer, simply open Simmons Bank Mobile on your phone and tap Open a new account in the left menu to get started! You will be led to a specialized account opening process for our existing customers.

You can find your nearest Simmons Bank branch by using our locations page.

Yes! Simmons Bank Online & Mobile{16} is available for all deposit accounts.

Call our online banking support number: (501) 907-0301.

We understand that technology can sometimes be a pain. Here are some suggestions for the least amount of resistance:

- Be steady when framing your ID in the predefined window.

- Find a well-lit area with natural light. For your selfie, face the light to avoid shadows.

- Find a neutral background and eliminate any clutter that might get in the way.

- Make sure you have a good connectivity to ensure the images upload and process efficiently.

Yes, you can open as many accounts online as you like! If you are an existing Simmons Bank customer, use your online banking credentials to streamline the account opening process to only a few clicks. If you are looking to open a Checking and Savings account at the same time, we recommend our Coin Checking + Coin Savings bundle.

-

{165} All accounts subject to approval. Restrictions apply.

-

{97} Benefits and features are subject to customer qualification and approval by Simmons Bank.

-

{213} Early Payday applies to direct deposit and other Automated Clearing House (ACH) deposit transactions, and is dependent on when the payer’s payment instructions are received by Simmons Bank. Simmons Bank will generally make funds from these deposits available the same day payment instruction is received or two days before the listed effective date of the payment, whichever is later. Simmons Bank reserves the right to terminate or change this practice without any notice to you and to place any restrictions or limits Simmons Bank deems necessary.

-

{201} Receive 0.25% over the Coin Savings account’s base interest rate when Relationship Premium A requirements are met or 0.50% over the Coin Savings account’s base interest rate when Relationship Premium B requirements are met. Relationship Premium A requirements: (i) have at least one linked Coin Checking account, and (ii) make a combined minimum of 15 purchase transactions (ATM and other cash withdrawal transactions are excluded), using debit card(s) of the linked Coin Checking account(s), that settle and post to the account(s) on or before the last business day of the month preceding the end of the Coin Savings account statement cycle to which the Relationship Premium will apply. Relationship Premium B requirements: (i) meet both Relationship Premium A requirements, and (ii) have a combined minimum of $500 in ACH transactions deposited into your linked Coin Checking account(s) that settle and post on or before the last business day of the month preceding the end of the Coin Savings account statement cycle to which the Relationship Premium will apply. To be linked, a Coin Checking account must have the same primary account holder as the Coin Savings account. Relationship Premiums will only be paid on Coin Savings account balances up to and including $10,000. Any remaining balances in the account will be paid the base interest rate. Pending transactions are not settled and posted. Only one Coin Savings account per account holder may be eligible for Relationship Premiums; if you have multiple open Coin Savings accounts, Relationship Premiums will only apply to the most recently opened account. Your Coin Savings and Coin Checking accounts are subject to other terms and conditions.

-

{266} Online opening for Coin Checking, Coin Savings, Coin Checking + Savings, Simply Checking, Simply Savings, Classic Checking and Elevate Money Market is only available to residents of Arkansas, Kansas, Missouri, Oklahoma, Tennessee, and Texas.

-

{16} Data connection required. Wireless carrier fees may apply. Mobile deposit is available to Simmons Bank online and mobile banking customers who are at least 18 years of age and have the most recent Simmons Bank App for iPhone®, iPad®, or Android™.

-

{19} iPhone, iPad, Apple, and the Apple Logo are registered trademarks of Apple Inc.

-

{108} Android, Google Play, and the Google Play logo are trademarks of Google LLC.

-

{171} Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.