Which benefits matter most to you?

Business Core Checking

A checking account perfect for small businesses with lower balances and fewer transactions.

- 75 processed items allowed per month without fee

- $5,000 in cash deposits allowed per month without fee

- $50 minimum balance to open

- $5 Monthly Account Maintenance Fee (waived with qualifying activities)

Business Plus Checking

A checking account ideal for growing businesses with moderate balances and transaction volumes.

- 250 processed items allowed per month without fee

- $10,000 in cash deposits allowed per month without fee

- $100 minimum balance to open

- $10 Monthly Account Maintenance Fee (waived with qualifying activities)

Business Pro Checking

A checking account that provides a competitive interest rate and higher activity limits for larger companies.

- 300 processed items allowed per month without fee

- $30,000 in cash deposits allowed per month without fee

- $100 minimum balance to open

- $20 Monthly Account Maintenance Fee (waived with qualifying activities)

- Earns interest

Non-Profit Checking

A checking account tailored specifically to non-profits.

- 150 processed items allowed per month without fee

- $10,000 cash deposits allowed per month without fee

- $50 minimum balance to open

- $5 Monthly Account Maintenance Fee (waived with qualifying activities)

Commercial Checking

A checking account for large, commercial businesses.

- Earnings credit allowance may offset certain fees associated with your account based on the analyzed account balance{44}

- $100 minimum balance to open

- Treasury Management services available

All our checking accounts come with:

Debit card | Simmons Bank Mobile | Access to 32,000+ MoneyPass ATMs

Designed with your business in mind.

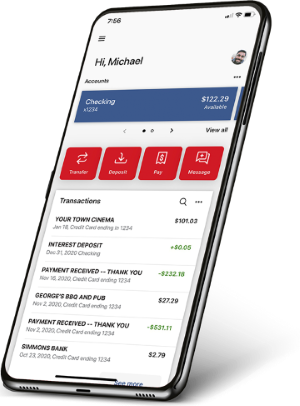

Simmons Bank Online and Mobile Banking lets you view and manage your money from any location.{16}

Go paperless and avoid a $5 paper statement fee.

Simmons Bank Online & Mobile

- Check your statements

- Transfer funds

- Deposit checks

- Manage and pay bills

- Setup card alerts

- Access business services

Get all of these features and more when you sign up!

Better checking from better benefits.

Call 877-245-1234 for deposits and loans, or 800-272-2102 for credit cards to access your account any time.

Make cash withdrawals and check your account balance at any Simmons Bank ATM.

Save a trip to the bank. Deposit checks from your smartphone or tablet anytime, anywhere with no charge.{16}

-

{256} Additional terms and conditions apply. Please see the Terms and Conditions of Your Account for additional information.

-

{165} All accounts subject to approval. Restrictions apply.

-

{44} Account analysis allows commercial customers to use collected balances on deposit to pay for certain bank service fees. An Earnings Credit Rate (set by the bank and subject to change at any time) is assigned to the average collected balance for the month. The earnings credit earned will be used to pay for certain service fees that have accumulated for the month. If the earnings credit exceeds the applicable service fees, no service fee is charged to the account. If the earnings credit is less than the applicable service fees, the difference is charged to the account. Excess earnings credit is not carried over month to month. Some Charges such as Stop Payment Requests, NSF Charges, and other charges that may be incurred are not eligible to be offset by an Earnings Credit Rate and will be charged directly to the account.

-

{16} Data connection required. Wireless carrier fees may apply. Mobile deposit is available to Simmons Bank online and mobile banking customers who are at least 18 years of age and have the most recent Simmons Bank App for iPhone®, iPad®, or Android™.